Stock of the Day

- Started

- Last post

- 630 Responses

- sarahfailin4

Facebook dropped 25% yesterday. Snap is up 45% today. Clearly we have no idea what these companies are worth.

Everything is bitcoin.

- The money just moves from one company stock to another, it's like watching a bunch of coke heads playing chess.zarkonite

- ^ Facebook down, Snap up, Spotify down, Twitter up...yup checks outgrafician

- Turns out that Snap turned a profit for the first time, at least there's a reason to pump their stock.zarkonite

- Sure, 5-10% but not 45%

Oh no, make that 57.51%grafician - stimulus money all over the placepinkfloyd

- Everything is bitcoin is not the right conclusion here.CyBrainX

- @CyBrainX Low liquidity?

But yeah agreed, these swings are not a good omengrafician - My anus is bitcoinbabydick

- _niko2

Just wanted to continue my thread from a couple of posts up and thank nb and mono for their input.

Imagine being on Dragon's den or Shark tank and you pitch to the investors. They love your idea and are willing to give you a ton of cash for a portion of your business. Company makes money, dragons make their proportionate cut, everyone happy.

Now imagine if instead you say "instead of giving you a direct piece of the company, I'll issue you shares. now these shares won't give you dividends or any profit sharing and I never have to buy back those shares but hey, you can trade them amongst your dragon friends or your buddies"

They would laugh you off stage no? But isn't this how the stock market works?

- what market do you belong to? i bet they'd take your stock off if you were a publically traded company.hotroddy

- Well what you describe is kind of like what they offer on shark tank, except they aren’t publicly traded companiesnb

- So, no, they wouldn’t laugh you off the stagenb

- Also Shark Tank is a TV show and does not represent realitynb

- Yeah for sure just using it as a simplified analogy obvious public companies are not shark tank but it seems that they raise funds but offer nothing in return_niko

- Its funny is that I run with the director of the securities and exchange commission 3 days a week yet here I am on a design forum taking shit from hotroddy lol_niko

- I’m pretty sure when I ask him he’ll pull me aside and say “mate, it’s just a big Ponzi scheme” :)_niko

- @_niko i think you must first meet certain conditions before you can think about getting listed + that's why shares have classes.sted

- &u know what ROI is and how it works?sted

- @niko, I've played golf with Arthur Levitt :)hotroddy

- and I don't quite understand it myself.hotroddy

- when you own shares you actually own part of the company and to me that seems more tangible than money. What is money but an exchange of trust.hotroddy

- You’re welcome. And yes that’s how it works. They sell stock to the public and people trade it among themselves. That’s it.monospaced

- If a company conducts a “buy back” it lowers the amount of available stock and usually increases price of remaining stock in the wild.monospaced

- Supply demand etc.monospaced

- The dream goal of any shark from shark tank is to be so successful with their business they can offer shares publicly.monospaced

- You ‘own a piece of the company’ except your ownership is subservient to bond holders and other secured creditors who own the company’s debt.monNom

- So your ownership is contingent on the continued functioning of the company as a going concern. If it runs into hard times, you go to zero. creditors get paid.monNom

- Stock market is a scamGnash

- Not if you invest responsibly.monospaced

- utopian0

- I sold and or moved all my stocks with the stock & financial investor and rolled them into my 401k. I was tired of calling to buy & sell stock and paying for itutopian

- Their commissions add up quickly and their transactions were too slow for my liking. I'm guessing because I wasn't their tycoon golfing buddy.utopian

- You had to call for trades and pay? You’re so full of shit utopian. That hasn’t been a thing in years.monospaced

- Schwab has instant trades. All free. All major brokerages offer that.monospaced

- Full of shit? I have had relationship with my broker for 15 years. I never used any technology to make my own trades until today. Fuck off know it all.utopian

- innovation at workmonospaced

- TO THE MOON!pango

- that is pretty hilarious utopian. very old school. https://www.youtube.…sarahfailin

- ha! Innovation never sleepsstoplying

- @utopian good to start with the hoodies.

but i think you're going to move to webull or something what actually give you far more options than robbinwoodiessted - Is this from that 3 stooges fantasy movie?scarabin

- Yeah were dis dude from?GuyFawkes

- Brb gotta send a fax to my broker about some bitcoinz, hopefully he'll page me back b4 my beeper battery diesGuyFawkes

- Ahahahahalvl_13

- ESKEMA7

LOL

——

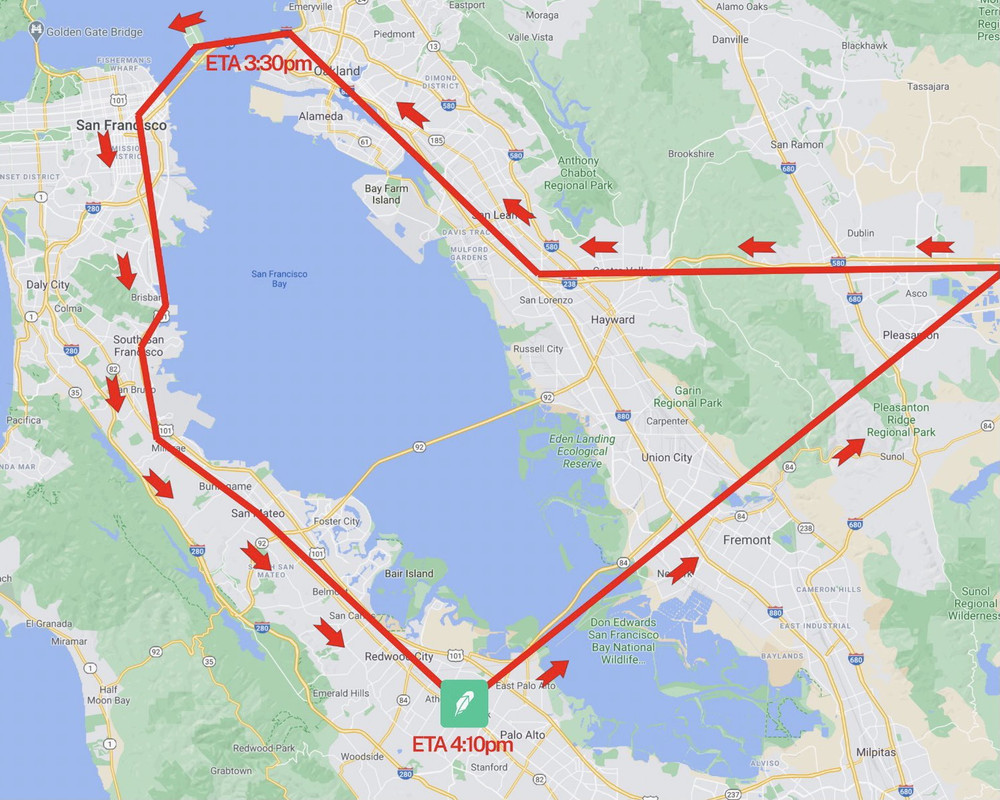

It's happening. At 3-4:30pm PST a plane will be flying a banner over San Francisco that says

"SUCK MY NUTS ROBINHOOD"

and I slid the pilot some extra $$ to circle right above RobinHood's HQ for a while. Go take some photos, I don't even live there Face with tears of joy

Here’s the flight path:

- zarkonite4

They shouldn't allow short selling, if you want to bet against a company you should invest in its competitors. At least this way it's tied to reality and not this magic math trading bullshit.

- Gregory from the walking dead was the personification of this. A swindler, grifter, was smarter than everyone else, didn't have to do any work or contribute_niko

- look how he ended up lol https://www.thesun.c…_niko

- short selling = borrowing and selling shares, with the aim to buy them back cheaper and return to lender, keeping difference.shapesalad

- short selling is a really useful tool. Ideally you use it to hedge in the first few mins/hours of a trade, just in case the market goes against you.shapesalad

- Selling something you don't own is ridiculous in any other circumstances.zarkonite

- then you can close your long trade at a loss, but make it back with your short. If your long is all good, you close short and put a stop loss in above your buy.shapesalad

- and the trades on stocks should reflect what's happening with the company in the real world, this is just a taking capital away from creating jobs.zarkonite

- It's a parallel economy that only deals in cash to make more cash.zarkonite

- I get how it works Shape, I've been doing it a long time. I just don't think it's good for society or the economy at large. The idea of buying stock was to helpzarkonite

- companies access capital to expand and create more jobs. This is totally not that.zarkonite

- @zarkonite +100Krassy

- @zarkonite +1000sted

- _niko0

after getting hammered for the past month and seeing a slow uptick, is it a good time to buy? and if so what?

airlines? oil? some other hard hit sector?

or

avoid it all like the plague? lol- don't usually invest, but I have this dreadful FOMO hanging over my head like this is a chance in a lifetime, but i'm clueless._niko

- If oil's down, buy oil.Nairn

- Disclaimer: I have made precisely £0.00 from investing in stocks.Nairn

- Having some experience, following the markets pretty closely, and listening to IMF and others, we're in for a global recession if not depression.mandomafioso

- lol Nairnutopian

- I'm all cash at the mo and def fomo'd the recent run up however it likely won't last. Poss better to wait til s&p tests bottom again, which many think it will.mandomafioso

- But what do I know? Maybe fed can print their way out of the problem. We're in uncharted territory.mandomafioso

- Is the recent upturn a dead cat bounce?Chimp

- This is a fake uptick, when the results are in (which is happening right now) it's going to be another sharp slide. Just my opinion...zarkonite

- Yeah, we haven't seen the bottom yet. Buy the best, make a list, diversify, ignore shiny objects.formed

- not a good time. Most companies need steady income to service their debts. if no revenue, bondholders will take over company making your stock a zero.monNom

- Fact: no one can predict the future. That said, buy buy buy!! or, wait wait wait a few weeks or monthsnb

- pockets2

nobody listened to BPTH, friend just made $118k today

- https://scontent-lax…pockets

- https://i.imgur.com/…pockets

- holy shit!lvl_13

- what are your sourcesdrgs

- https://media.giphy.…pockets

- moar plzzz pockets - make us all rich xoxoxopedromendez

- pockets, help us fill our pocketsKrassy

- But how much did they lose yesterday? ;)microkorg

- $0pockets

- Oct 2017. $7 to $77 to $9 in 3 days.toemaas

- Hayzilla2

Anybody got any hot tips on green energy companies to invest in?

Outside the usual Telsa, Rivian etc. I'm not looking for a quick buck, I'm not even that fussed if I get very small returns in the first 5yrs. I just feel strongly in helping the industry in general to get us all off these damn fossil fuels. Profit would be a bonus though.Hit me >>

- Have you considered climate-conscious ETFs?nb

- Unsurprisingly, these are difficult to find.nb

- I have a green mutual fund that has been doing great and that I've held for years, if that interests you. Let me know.monospaced

- Sounds ideal mono. Whats it called?Hayzilla

- DUK, but that's long-term, dividend player. I am still up more than a 100%, though.formed

- NEE and TANformed

- The one I hold is NEXTXmonospaced

- I just bought EAF. They make super efficient blast furnace something or others. ENPH has been a winner for me too.mandomafioso

- CANOO (symbol GOEV) is building ev plants in Walmartsville Arkansas, Oklahoma etc. Share price is currently around $10.stoplying

- drgs2

- not a scammonospaced

- Everything that goes up.

Must come down.

No homo.utopian - nutzdasohr

- can't stop, won't stop.sted

- Kid Icarus. One day it will be flying too close to the sun.NBQ00

- $VTI 'til I dietrondlandvik

- bainbridge-1

Best stocks to invest in when the world opens for summer?

- Whatever's going to be similarly popular in Autumn, I guess.Nairn

- Travel-related ETFs would be my guess. JETS, for example.Continuity

- Yeah you could play the tourism card with hotels and such i suppose, and airlines.monospaced

- You already missed the boat ;-)formed

- Boat stocks?CyBrainX

- sun lotionneverscared

- condomsKrassy

- vanguard indices?kaiyohtee

- Patagoniai_was

- NBQ000

How do you spot “hot” stocks on WSB early? I mean is there some kind of authority figure or posters with good track records?

All I see is constant noise and a lot of “diamond hands you apes” BS.

Where do you actually get the early picks there?

- don't bothermonospaced

- Ask your wife's boyfriend.palimpsest

- QBN. Shhhh_niko

- I've started watching your day trader video above, but before I finish it I want to add my 2¢. As someone who has no clue and just dabbles in the stock market,_niko

- it seems to me that if you have a large enough bankroll, say 100k, all you have to do is keep your ear to the ground and put your money on a stock that will_niko

- ...jump a meagre 1% and you've made $1000 which is a great daily income. Now if you do the same with $1m, you're making $10k/per day on only a 1% bump_niko

- the problem is, I'd imagine is that it's impossible to predict even a 1% bump in stock price unless you have insider knowledge. Apple release record earnings_niko

- Yeah niko, 1% a day theory is easy. Do you know how many billion-dollar hedge funds there are who keep losing money.NBQ00

- numbers and their stock took a dive. I've seen a few others do the same, so maybe it's a bit of a gamble after all._niko

- yeah NBQ00 exactly, if it were that easy, these hedge fund traders and other whales would be printing money, but it does seem like they do._niko

- @_niko more like they want way bigger returns; sure, what you said it's all good for a regular joe, but you need to do 5% to cover inflation, commissions, etc.grafician

- @_niko oh wait, you said 1% A DAY lol

so 20%/month? hmmmgrafician - Use trading view. Filter for relative volume and pre market gap. Look for what is moving towards extreme with those indicators.shapesalad

- You could also say if 1% a day was possible you could use compound trading and make trillion $$ in no time. If it was possible somebody would’ve already done itNBQ00

- I made more than $1,000 on just AAPL today alone.monospaced

- graf, 1% a day but not every day, so you have to pick a different stock or stocks to collectively make 1% and sell them. it seems easy. But I'm sure it's not_niko

- @_niko yeah, but that is not investing, that is very conservative day trading

@mono so you have $50k on AAPL? interestinggrafician - yeah graf, that's what I'm talking about, how possible it is to make 1k/day with a 100k bank roll conservatively selling after a 1% gain._niko

- @_niko $1-2K a day is very doable, with a little research upfront to pick a few stocksgrafician

- @graf, yes. I put $750 down a long time ago on 15 shares (estimates). It's now worth like $60K, and that's after I used a chunk to buy a house.monospaced

- I don't see how that's interesting though.monospaced

- I bought 50 shares when they released the iPhone. It split 7 to 1 in 2014, giving me 350 shares. Then 4 to 1 last year, giving me 1,400 shares.monospaced

- Follow mono - buy a good company with growth potential. Diversify. Then worry about gambling.formed

- Remember, "80% of day traders lose money over the course of a year with the median loss of -36.30%!" Day trading is a sucker's game.formed

- it's actually over 95% of daytraders losing moneyNBQ00

- Swing trading is better. Day trading needs a constant supply of expressos, high speed internet, super fast desktop pc, 20 monitors.shapesalad

- In the long run, you don't stand a chance.

The glamour of big returns and "diamond hands" is all marketing to attract new blood and dumb money.monNom - Nobody brags about slowly losing everything as they furiously double down and take larger risks trying to get back to even. You only ever see random lambo guy.monNom

- Because no matter what, you have inferior information compared tp the pros, or the pumper on reddit. If you're not in the club, you are their food.monNom

- Krassy2

Reddit trader ‘Roaring Kitty’ behind GameStop rally says he lost $13MILLION in one day

- I wonder if he's actually still holding.

(I didn't bother watching the vid)Continuity - He's holding.

Diamond hands.

To the moon.palimpsest - Etc

Etc

Those autists must really get tired of typing that eeeeeeevery day.Continuity - https://twitter.com/…palimpsest

- Wow.Continuity

- He hasn't really lost any of that money, the value of the stocks & options he holds decreased. His position's current value is 22M.dorf

- butbut -13M writes the next article

wait wasn't that just 7m? :D

nice subliminal message with that "i like the stock" line :)sted - What’s gamestop?maquito

- You serious?

It's what we've been talking about this whole past week.palimpsest - He didn't lose the money, his overinflated $GME shares are currently worth $13m less than a few days before when they were spiking.mekk

- Still owns a boatload of shares at an unrealistic high price, should sell and just enjoy life at this point.mekk

- WSB waiting for GME to go to the moon is like QAnon folk waiting for trump to arrest the pedos and be president again. what is the common denominator??dorf

- ^ difference is, WSB is aware that they might be wrong and made a cult out of being wrong and posting lossport. It's called BETS for a reason.mekk

- @mekk

Are you telling us that if we buy a stock at $1 that goes up to $11 later comes down and we sell at $6 we haven't made $5 but rather lost $5?palimpsest - My retard brain got that mixed up, you actually said the opposite. ;)palimpsest

- :-)mekk

- I wonder if he's actually still holding.

- NBQ000

GME under 100

- 80's nowNBQ00

- Show's over, boys. Go home.Continuity

- Funny now not only the hedgies lost a lot of $$ but also most of these autists.NBQ00

- It's only going down because diamond hands are too heavy, can't fight gravity... will go up with light paper hands.shapesalad

- @NBQ, just looked it up and GME is still heavily shorted as of 2 days ago.Continuity

- Buying GME at different prices is how you diversify.

palimpsest - I'm impressed. It's managed to limp its way back over 100.Continuity

- 1K is not a meme.

Hold the line.palimpsest - Maybe we should try to meme a stock here at QBN, get filthy rich, and watch as others pile on too late.Continuity

- Not sure what the media would make of what QBN is, though, and that would be half the fun.Continuity

- ^ media would think QBN is related to that Q anon shit so...grafician

- i dont think there are enuf of us hahamantrakid

- ^we could make a blip. for a fraction of a second lolcherub

- we could, but i would definitely sell before all of you, and take your moneymonospaced

- SteveJobs2

- YT comments:

"He’s lying. Even his eyebrows are trying to run off his face."

"How his pants haven’t caught fire is a miracle."imbecile - what i can't understand that they have a powerful user base, and yet they bend the knee for uncle melvinsted

- What if uncle melvin has something else to offer? like legislation influence, bending the rules for their favor?sted

- even if its a lie i found that far more powerful influence factor than the short term profits.sted

- Vlad's a billionnaire; he's not after the $; sted is right - powerful influence factors are at playKrassy

- It's called Capitalism!utopian

- He kept repeating marketing talking points instead of answering the question. Good move, vlad.cherub

- It‘s not just Robinhood, I noticed this kind of shit happening in many other brokers during crucial times. Either you couldn‘t login or there was an outage or..NBQ00

- ..they restricted the trading. Always happened during very crucial times when you had to react quickly. The casino really makes it hard for you to win.NBQ00

- YT comments:

- Hayzilla0

My mate has been texting me constantly about this shit for 24hrs. He's jumped in on all of them. GME, NOK, EXP, AMC, DOGE. I secretly hope he loses money LOL.

- He probably will as he may have jumped in too late.NBQ00

- Buy high, sell lowdrgs

- What stock ticker is LOL?

;]BH26 - Best time to buy a stock is when literally every cunt's talking about how much money they're going to make off it. It's obvious.Nairn

- My friends too. Totally losing it right now.monospaced

- Well, now GME is going back up, so ... who knows.Continuity

- A stock which does 400-100-250 in one hour is worth nothingdrgs

- Yep.sted

- @BH26 LOL got delisted go NICE.sted

- tell that to Nikola stocksarahfailin

- lol i still can't puzzle out how that shit went up to 30.sted

- it's simple ... because people bought the fuck out of it, driving it up, with no consideration for their own earning or loss potentialmonospaced

- basically, they tried a bitcoin tactic, because they wanted to reverse a major hedge fund short position that got a big boy bailout.monospaced

- ah sorry I was talking about Nikola which is a miracle that didn't become a penny-stock or even delisted.sted

- dasohr1

All this trolling of the market has got me interested and I ain't got much to do in my spare time so... I have some questions, what platforms do you use? Where do you trade, Robin Hood, Vanguard? Just looking to see what's out there. Thanks fam.

- I was going to ask this same question. Was using yahoo finance but it is pretty useless for your mobile app.eryx

- Most people use a brokerage account. Personally I use Charles Schwab and have for 30 years. Highly recommended.monospaced

- ha ha.. mobile app trading = you are going to burn your savings long term.shapesalad

- if investing long term, vanguard, pay in monthly, average market price, keep doing for 10+ years.shapesalad

- If trading, at the least you need a big monitor, you need to see multiple charts at once, at different time frames, you need to see data to trade.shapesalad

- I've got a Vanguard account, Acorns, Robin Hood and Merril Lynch brokerage for RSUs. They all serve slightly different purposes – Robinhood is just for fun!DaveO

- On Robin Hood's selling of data a banker friend of mine said that "If anything in finance is termed 'free' – YOU are the product"DaveO

- You can also just invest in growth without all the charts and monitors n shit. I trade regularly with my phone on Schwab. You can do it as infrequently as u wismonospaced

- Solid, thanks QBNFAMdasohr

- I use Schwab. I'm mostly a buy & hold ETF type of person, but I'm pretty happy with the platform.section_014

- Old ass Schwab for long term stuff, TD Ameritrade for the short-term shit, Webull because of AH/PM trading (+that interface is sweet) and recently a Hoodies.sted

- I have Tradingview but only to run 2 paid and a custom algo, +joined this year a discord channel what is loaded with really nice ppl :)sted

- sarahfailin3

https://www.reddit.com/r/wallstr…

WallStreetBets redditors caused GameStop to rally 50% this morning by creating a short squeeze. They also piled into Blackberry stock, causing a major rally there as well.

"[GameStop] has become a high-profile battleground between bullish chatroom-driven day traders, especially on online platform Reddit, and hedge fund short sellers, who have been betting against the stock.

GameStop has been the most-actively traded stock by customers of Fidelity Investments in recent sessions, with buy orders outnumbering sell orders by more than four-to-one, according to the brokerage.

“We broke it. We broke GME at open,” one Reddit user wrote Monday after the NYSE halted trading, referring to GameStop’s stock-market ticker." https://www.wsj.com/articles/gam…

Surely some reckoning is at hand... what rough beast slouches towards Bethlehem to be born?

- just read this madness

reddit.com/r/wallstr...sarahfailin - http://www.reddit.co…sarahfailin

- lol, so Redditors are fucking up hedge fund douches who were trying to short the stock? am I reading that right? that's amazing if so_niko

- what the hell, it went from $18 to $183 in January?_niko

- Amazingsection_014

- yeah i had to put back my face after looking at BB today. GameStop started to get interesting two weeks ago...sted

- the WSB reddit has 2.3+ million members with money, time and Robinhood accounts - sounds like how the 1920's stock market started out toospot13

- I was happy to cash out of BB after holding for a year+ so now I'm jumping on the GME ride to see what happens, lolspot13

- just checked out from GME.sted

- just read this madness

- DaveO3

Is all that Reddit action not classed as manipulation?

- Nonb

- When does the maniuplation charge kick in? I heard that the 'Essex Boys' were under threat from that when they all shorted the oil spikeDaveO

- https://forextrader.…DaveO

- reddit directly? i don't think that it will ever. for a user/users maybe, spreading false information on a subreddit can worksted

- Any different than hedge fund guys shorting a stock for no reason which causes it to tank which in turn makes them rich?_niko

- it's all out in the open so it's like the opposite of insider trading, the big difference here is reddit investors are a different type of sheepspot13

- Retail investors, don't know anything about finances or the market, and they're just gambling money away.sted

- Hedgies hate that these tools are available for everybody, and the much larger community behind them.sted

- Hedgies Shorting happens for a reason, and the borrowed money behind these operations is far greater than an average person would be able to comprehend.sted

- drgs2

- Negative even https://www.ft.com/c…drgs

- what stock?monospaced

- I want a million gallons, here's 1 dollar!grafician

- Just crude oil. There will be written books about todaydrgs

- https://www.zerohedg…NBQ00

- You get paid for buying oil? I know in some countries they had negative electricity prices, which I understand, but oil?drgs

- It is possible if there is a delay in how soon oil companies can adjust production to demand. Their storage is overfilled and they pay to get rid of oil?drgs

- apparently a lot of experts are scratching their heads about this too. there will be blood.sarahfailin

- If you buy it, The problem is storing the physical barrels. China is currently building massive storage facilities, also some companies building offshore.BH26

- teh0

Market turmoil over Trump cost Mark Zuckerberg $2 billionFont size: A | A | A

2:45 PM ET 5/18/17 | MarketWatch

By Sally French, MarketWatchMark Zuckerberg's portfolio had a pretty rough day

The folks in D.C. aren't the only ones having a bad week. Billionaire Mark Zuckerberg lost more than $2 billion as a result of Wednesday's turmoil in Washington.

And Zuckerberg is not alone; the world's 500 richest people lost a combined $35 billion on Wednesday, according to the Bloomberg Billionaires Index (https://www.bloomberg.com/billi...

Facebook Inc. (FB) founder Mark Zuckerberg, who is the fifth-richest person on the planet with a net worth of $62.3 billion, was hit the hardest as the Nasdaq saw its worst one-day decline since the day after U.K.'s vote to exit from the European Union (http://www.marketwatch.com/stor... rattled markets. Zuckerberg lost $2.2 billion as Facebook shares dropped 3.3%. Just don't start feeling too bad for the guy; his net worth is still up $12.3 billion year to date as Facebook shares rose 27.91% over the same period.

Amazon.com Inc. (AMZN) founder Jeff Bezos, who is the third-richest person on the planet with a net worth of $81.9 billion, lost $1.71 billion as a result of yesterday's brutal selloff. Mexican business magnate Carlos Slim and Microsoft Corp. (MSFT) cofounder Bill Gates, who is the richest man in the world, both lost more than $1 billion.

Trump, who has a reported net worth of $3 billion, does not make the Bloomberg Billionaires index, which only ranks the world's 500 richest people.

U.S. stocks are staging a rebound on Thursday. The Nasdaq is up nearly 40 points, supported by rebounds in major technology names, including Apple Inc. (AAPL), Amazon.com Inc. and Facebook Inc., all of which are up more than 1% on the day.

- 'lost'.detritus

- cost him 2 billion Font sizes?!? Jesus. H. Christ... that is a lot of font sizes.kona

- There is a God.utopian

- no it's one font size that costs $2 billion. really big font. really big.sarahfailin

- That's just Hoefler & Co's charge.detritus

- haha!teh

- Who fucking cares white boy shithead comptron problems #fuckitdasohr

- he hasn't lost anything. it's vapour.Gnash

- I'm going to bill clients based on the font size.shapesalad