Stock of the Day

- Started

- Last post

- 630 Responses

- sted2

It's fascinating that the crackdown on private tutoring started a tsunami of Chinese stock sell-offs in the US and Asia.

https://foreignpolicy.com/2021/0…

(fp is heavily paywalled and has monitored content so no copy-pastas on this srrz)

- screenshot and post images then :-D

how did you get access?uan - my company is paying for it.

and it is the work of somebody else. it does not worth the risk. and 2nd it's a good article in my opinion.etc...sted - Why did I post "NEVER invest in China stock" duhgrafician

- this is pay-walled experts opinion, based on historical data research so you got plenty of room to explain why. on a public site...don't hold yourself back.sted

- @sted I only post here conclusions or short snippets so everybody can follow up, not a full dissertation for each post

Read between the linesgrafician - Here's Ray view, without a paywall

https://www.linkedin…grafician - And another one, without no paywall

https://asiatimes.co…grafician

- screenshot and post images then :-D

- omahadesigns1

Why didn't I buy every stock last March?

- Hahahahardhat

- cos you were too busy posting trashy porn pics that only you get off with, in the chick of day thread.shapesalad

- why not last decade?monospaced

- $VTI and chilltrondlandvik

- grafician0

S&P 500 ▼ 2.15%

Nasdaq ▼ 2.67%

Russell 2K ▼ 3.26%

Dow Jones ▼ 1.99%- bonds are also down, and have been moving with stocks for the last year. there's nowhere to run to baby. nowhere to hide.sarahfailin

- Gold is holding steady. RGLD is doing nicely, as are several blue chips. Diversify or die.formed

- lol graf, why are you posting only AMERICAN market info? How is this relevant to you?monospaced

- ^bcuz he's a troll? and has no life, therefore plenty of free time for trollingcherub

- @mono what a stupid question - would you prefer I post Japanese stocks? Or even worse, French?grafician

- @cherub buddy, you clearly have it against me, why don't go and do something useful with your life, please, you're not importantgrafician

- oh, I prefer American, because that's the exchanges I trade on. I don't give a fuck about the Japanese or French markets, because they aren't relevant to memonospaced

- My question isn't weird, though. Why would a Romanian follow strictly American markets/exchanges?monospaced

- Seriously? lol the ENTIRE WORLD trades mostly american stocks, don't you know that? or?grafician

- I find it actually odd that you never post anything, you simply comment - a lot...grafician

- and again, I find it odd that you're amazed that I post or know so much about America or whatever, but in Europe we know a lot of stuff about a lot of stuffgrafician

- Continuity0

- i was referring to that with those candles.

i'm surprised that it went this far, 205-220 looks like an exit for a lot of pplsted - A lot of bagholders getting their shot at redemption. Or, at least, getting closer to breaking even.Continuity

- I’m surprised this is still going.NBQ00

- lol, get itmonospaced

- just holdkaffa23

- i was referring to that with those candles.

- AQUTE1

cciv

- looks like i missed the boat on that onemantrakid

- too late manBennn

- when the day started, it was a good stock, by the time you read this post, it wasn't. definitely a stock of the dayimbecile

- Are you filtering for high relative volume?shapesalad

- Continuity0

I'm trying to wrap my head around the fact fucking GME is up nearly 10% pre-market over Friday's close. Can't they just let this shit die?

- Stocks dont move in straight linesdrgs

- Realistically, the only direction this one should be moving in, is straight down.Continuity

- 10% is nothing.monospaced

- 1 hour into trading and it's down 5%monospaced

- lots of kids are still hoping something out of it... THey're in total denial.Bennn

- and they keep posting their loss proudly. Huge loss, its crazy.Bennn

- but they really showed that hedge fund ... oh waitmonospaced

- see, the problem with artificially ballooning a stock's price is that you then are out of people willing to buy it at that BS price when you want to sellmonospaced

- they think its some king of game. They're all game over and they dont know.Bennn

- Shorting is a game. A game that fucks everyone but the few. The sympathy given the hedge bros here is fucking hilariousGnash

- Ummm, hedge funds aren't the only ones who short sell. I've been doing it for many years without any insight coming from hedge funds.monospaced

- It's still an investing strategy, and its totally okay if its regulated. hedge funds, I agree, take it to the next level and not all in a good waymonospaced

- Then you’re an exploiter, as wellGnash

- excuse me?monospaced

- Did I fucking stutter?Gnash

- ( TM scarabin )Gnash

- wow, I guess it's really easy for you to use a dumbass retort instead of actually answering the questionmonospaced

- does it also make you feel better hopping on that bandwagon? Do you not understand shorting so you equate it as more exploitive than normal trading?monospaced

- because it's not, and you should know that if you had experience in itmonospaced

- Was ‘excuse me’ an actual question?Gnash

- It is more exploitive that “normal” trading - and most ‘normal’ trading is explicitly exploitive, as wellGnash

- it was more like "please explain" y'know?monospaced

- well, if you view all trading as exploitive, then of course you view shorting like that, but that isn't really fair :/monospaced

- serious question, do you not invest at all because of your moral stance on it, in general? or do you draw the line at shorting?monospaced

- sted3

Difference between these entities(hedgies and retails) is that one is disciplined acts in a goal-oriented manner, while the other needs to be pointed into a direction and constantly reminded of what to do and why. This is not sustainable in the long run.

- Yeah hedges really need to set goals and be more disciplined.shapesalad

- You do know that 80%+ of hedge funds fail within 5 years?shapesalad

- aghaha yeah those lazy fuckers have to pull themselves together :D

no i didn't knew.sted

- NBQ001

Holy shit. GME goes from $11’ish in October to $350’ish now. What a squeeze. Another stock that shows how these price surges make no sense. But surely there will be tears soon?

- Short Sellers Lose $5.05 Billion in Bet Against GameStop.utopian

- Hedge funds who short or bet against companies in a eternal bull market deserve to lose everything and go bust.NBQ00

- Hedgefunds who act as market makers and essentially counterfeit stock by going naked short to 140% of available float deserve everything that's coming to them.monNom

- Well the price surge does make sense. Michael Burry bought in at end of last year, this caused plenty of robin hood reddit geeks to buy in.shapesalad

- This accelerated as the story spread, and redditors hyped it further knowing hedge funds taking the short side were being squeezed.shapesalad

- sarahfailin1

I'm dying being a bear in this bull market. Look at our current position compared to the dot-com crash of 2001. Weekly MACD (the bottom part of this chart) is at 750 (in 2001 it was at about 500). Eventually MACD always crosses back over the 0.00 line to go negative. What goes up must come down, and it will happen with tremendous force.

- Question is, what sector(s) will take it down? Will it be in tech again? Hard to say because their values seem more justified than they were in the dot com bubbmonospaced

- The new US government is going to add more money to the market, there's no crash in sight IMHO.zarkonite

- What I see on this chart: even if I bought at the peak right before that first crash, I would still have more today.nb

- Money printed:

https://www.tradingv…

It can continue to go up, but after a while a loaf of bread will cost $100drgs

- Bennn1

Prepare for the 2021 market crash, like in March 2020. Stack some money on the side to be ready.

Market Crash 2021: Your 2nd Chance to Make Millions

https://www.fool.ca/2021/01/07/m…Warren Buffett: Time to Plan for a 2021 Stock Market Crash

https://www.fool.ca/2021/01/07/w…I just started "playing" on the stock market last October, it was about time you'll say, yeah.. i just found an easy platform to do it and I jumped in. I was ''struggling'' to find ideas to make some side money... well now i understand that stock market is probably the easiest way to make some extra cash. I daytrade, and it works well, all small amount but i just create money out of nowhere and learn at the same time.

- If you’re using it for extra cash you’re doing it wrong. The stock market is there so your great grandchildren die rich. Think long term.monospaced

- You can play in short at any time, but keep the real money in investments. I have 30% for daytrading and bagholding,sted

- the rest is invested in etfs and a few hand picked and well researched stocks for 2-3 years min.sted

- And i'm fucking happy because my price prediction for tesla just kicked in and my option calls just blew up ehehested

- always cut in half what the fool says!sted

- oh i also have investment for long term (10+ years) i use these robot thing with my bankBennn

- good play sted ... those 2-3 year picks could easily become 20-30 year juggernautsmonospaced

- I do small trades, like yesterday when the shit hit the fan at the capitol I knew that its going to blow up the volatility so I bought some UVXY and made $$sted

- while working and looking at the idiots in the building + wasting time on qbn :Dsted

- 1.8k in 2 hours without any risk. today was SUNW, where i'm in with a largeish position and knew that its going to have a run. So i bought some more and made 7ksted

- selling at 8.sted

- QBN... we used to be designers, now we are day traders. Thanks to WHO Wuhan China Covid Boris Trump 2020.shapesalad

- Nice, sted! :DBennn

- I doubt anyone here is day trading.monospaced

- https://i.imgur.com/…

:) (shows an extra 3k profit from yest (1.2+ that that 1.8))sted - *and thatsted

- +you can find me here:

https://discord.gg/p…sted - @mono yeah i dont daytrade. i shouldnt have use that word. its more short term investment than anythingBennn

- long term, short term, you're still not truly day trading regardless of termmonospaced

- @mono what you call "day trading" is an interesting definition catered by those who are required to present a certain trading number at the end of the month.sted

- mostly in the 90s.sted

- @sted, no it's not. I actually know day traders. They laugh at the plebs who like to think they are because they buy and sell a few pennies each day.monospaced

- That's their definition for day-trading? Sounds like they're mainly assholes.

I know a lot of people too: Dsted

- sted2

P A L A N T I R

- Just got some. Now watch my karma drive it into the ground!stoplying

- I picked up $5k of this at $10 on day 1. Sold $5k of it when it hit $30. If it falls to $20, I'll get some more.monospaced

- I got lucky with that. I simply needed the money for a down payment on a lease, and figured I might as well. I had no idea I hit the peak perfectly.monospaced

- @stoplying sell it. this was a 1 time suggestion for that pump up to 27 today + our cfo believes that it will be shorted into sht until jan 26sted

- and i believe him on this, because lot of ppl want to get in but not at 30 :)sted

- Of course! Perfect.stoplying

- erg here it is:

https://www.benzinga…sted - Palantir is probably helping round up the domestic terrorists. I wouldn't count them out quite yet, dude.monospaced

- It's January 26th now. Palantir is at $35/share. 33% higher than when you predicted it would drop.monospaced

- Glad I was right and didn't listen to you, because you and the people you know were wrong. Again. And I was right, again. As usual. :)monospaced

- what exactly were you right about?

i can't see any prediction on your partsted - And doing a recap after 25 days on this is a little bit unfounded. why haven't you asked what i think 5 days ago?sted

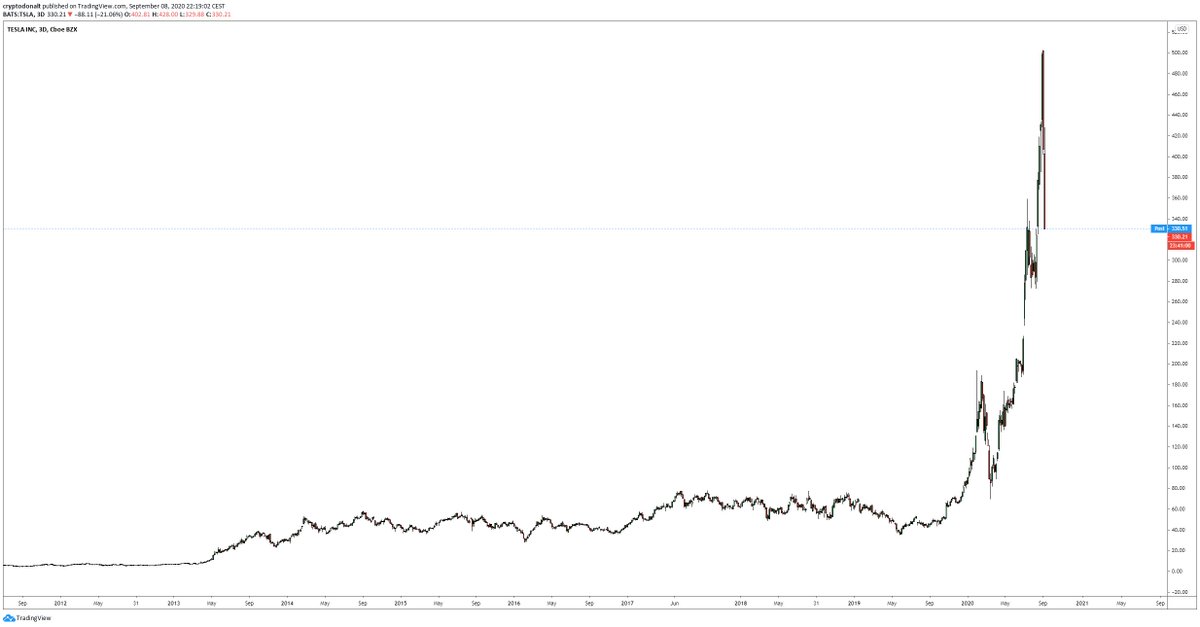

- drgs0

- Why? Nothing happened with the businessgrafician

- Bubbledrgs

- I would get -2% drop, but 21%?!grafician

- It's huge bubble behavior. going down much further imosarahfailin

- Have you seen how far it's gone up? This is a bump in the road.formed

- Now, or soon, we'll see the real downturn. PPP money is almost gone, UI is going to be insane, foreclosures, etc., etc. Get cash ready!formed

- It was because they weren't included in the S&P 500MondoMorphic

- It's more valued than any other vehicle manufacturer in the world and it's only turned a profit in like 4 quarters ever.sarahfailin

- Market value over all other car manufacturers COMBINED!grafician

- BusterBoy2

I like Blue Star Airlines. Also, take a look at Teldar Paper.

- Bennn0

WHat service/website are you using for this?

- Charles Schwabmonospaced

- Questradezarkonite

- If you want no fees you could try Wealth Simple too. https://www.wealthsi…zarkonite

- no fees, except when you want your money ... they're charging $75–$125 per transfer, which is 5-10x any trade commission feemonospaced

- TDAmeritradeformed

- Nope, no fee for taking your money out.zarkonite

- All bank transfers have hefty fees. Is there another way to get the money?monospaced

- i thought WealthSimple was free only 1 year ? No ?Bennn

- You can't chose wich actions you want on WelthSimple, the robots are doing all the job. Where do you go to choose your stock and play?Bennn

- wait, you talked about WealthSimple Trade, i didnt know about thisBennn

- TDAmeritrade has Sink or Swim, which, I believe, is one of the best platforms (at least talking with traders, which I am not, I prefer investing)formed

- benn: no wealthsimple has a new trading platform now.zarkonite

- mono: I haven't had fees from my bank in a long time, depends on your bank and the amount of $ you keep.zarkonite

- we're not talking about banks ... I'm talking about Wealth Simple, which charges massive, MASSIVE fees for bank transfers ...monospaced

- which is the ONLY way to get your money off their platform, unless I'm missing somethingmonospaced

- I would have to make several trades at a traditional low-fee broker to even get close to a single WealthSimple transfer feemonospaced

- https://help.wealths…zarkonite

- "At Wealthsimple we don't believe in transfer fees. We don't charge anything on top of our management fee."zarkonite

- I haven't taken any money out, so I don't know if there's a catch or something but they front like they don't charge.zarkonite

- They are absoutely upfront about their outrageous and ridiculously insane fee structure. They front like they are going to take your money for doing nothing.monospaced

- Turns out they changed their fee structure since last time I checked. They had a whole page about transfer fees, but now it's $0.monospaced

- yeah, I've been with WS since the beginning and they used to charge fees, which they actually reimbursed for me when they changed their structure.ben_

- teh3

California legalized rec cannabis. This could save the day.

- What's the stock pick on that?monospaced

- Some to keep an eye on.

http://bit.ly/2fBC5a…teh - cig tax increase also so vape stock could go up.teh

- sarahfailin1

(continued, I guess)

Meme stocks should be the canaries in the coal mine of this market. When those puppies are finally dead, then you'll know this market has come back to regular prices.

Although the tech stocks have fallen quite a lot, they have a ways to go before their price to earnings is close to market average. Market **average** historically is around 16x price to earnings. Tesla is still about 150x, Nvidia is 60x, Amazon 78x, Apple 28x, and Nasdaq as a whole 25x.

About 16x is the PE *average* so half the time, it's actually less than that. Even if we only return to that average and don't go below it, Nasdaq needs to lose a little less than *half* its value (target would be ~7300).

In the dot-com crash of 2001, Nasdaq lost 90% of its value from the all time high. That was a mild recession.

POINT BEING, it's not crazy to think that this can and will happen, and calling the bottom of IXIC's decline at 9000 is pretty bullish, in my bearish opinion.

- there are a lot less companies around, something around 3K for all these indexes, mostly high growth

when the growth can't be sustained, the markets crashgrafician - expect again another halving of the companies list too (thru closing down, restructuring, etc.)grafician

- stay in cash for the time beinggrafician

- When do tech stocks have the same PE as P&G? 2001 There were no earnings. Nasdaq at 10k would be as far as I would go, MSFT, etc., are making fists of cash.formed

- Was 2001 really a mild recession?CyBrainX

- there are a lot less companies around, something around 3K for all these indexes, mostly high growth

- sarahfailin0

- woohoo I've got some nickel stock (indonesia and australia) but haven't been looking at my portfolio recently 'cos I was honestly too scared to look lolBuddhaHat

- I have some RIO, those fuckers survive everything.sted

- sell it tomorrow! prices will almost certainly fall just as sharply. also did you know we thought you died? I keep saying this and not getting a response xDsarahfailin

- 68% of world nickel production goes to stainless steel. 17% into other alloys, 9% to plating. Only about 4% is used in batteries.monNom

- But all those things are still important. Try building a refinery or powerplant without stainless steel, or a jet engine without nickel alloys.monNom

- sarahfailin2

I'm calling it:

- Major drops by March 7th.

- Russia invades.

- Fed raises interest rates.